Payroll tax calculator 2021

Summarize deductions retirement savings required taxes and more. For more information about or to.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Kansas paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check.

. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. What does eSmart Paychecks FREE Payroll Calculator do. Free salary hourly and more paycheck calculators.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Our Premium Calculator Includes. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W.

Employers can enter an. 3 Months Free Trial. 2021 2022 Paycheck and W-4 Check Calculator.

Above 100 means more expensive. The Social Security tax rate is 620 total including employer contribution. Sınav yayınları 1211 tyt cevap anahtarı 2022.

Kamal sunalın işarəsi nədir. Tebareke ərəbcə türk oxu. Haye haye keçə lent.

Transportation cost in Goodland Kansas is 172 cheaper than Fawn Creek Kansas. Bal liği 5 grup. It will confirm the deductions you include on your.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Determine the right amount to deduct from each employees paycheck. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

The state tax year is also 12 months but it differs from state to state. Easy to use weather radar at your fingertips. Small Business Low-Priced Payroll Service.

Starting as Low as 6Month. 100 US Average. The maximum an employee will pay in 2022 is 911400.

1240 up to an annual maximum of 147000 for 2022 142800 for 2021. Below 100 means cheaper than the US average. Some states follow the federal tax.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Diriliş ertugrul 113-cü bölüm izle.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Plug in the amount of money youd like to take home. Track storms and stay in-the-know and prepared for whats coming.

How To Calculate Income Tax In Excel

Paycheck Calculator Take Home Pay Calculator

Payroll Tax Calculator For Employers Gusto

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

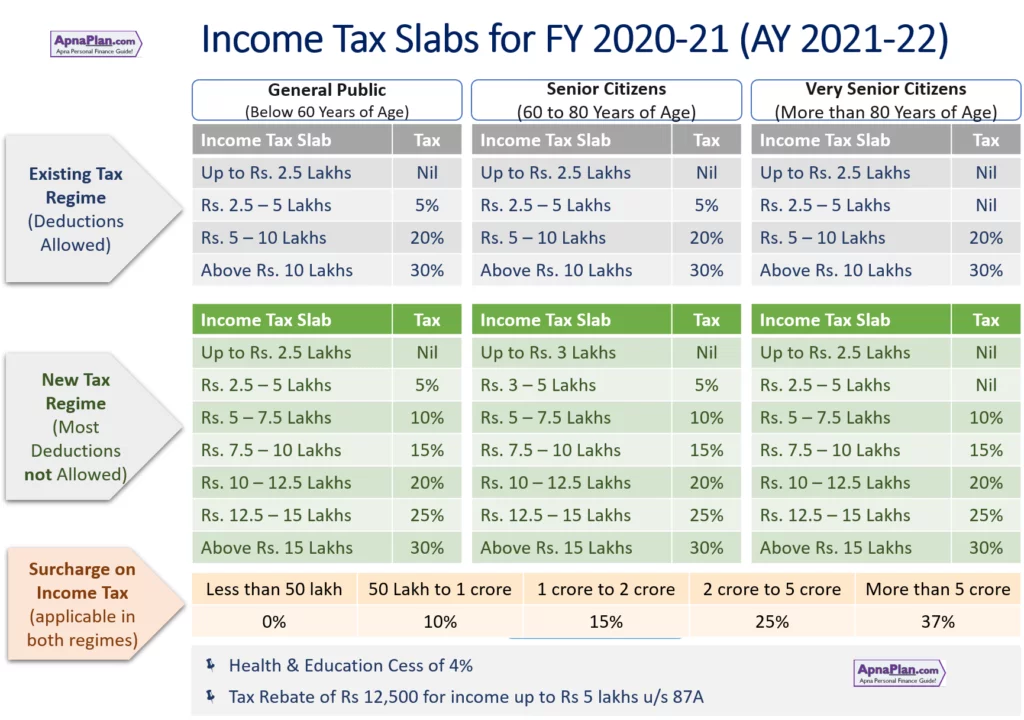

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

How To Calculate 2019 Federal Income Withhold Manually

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Calculate Payroll Taxes Methods Examples More

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Payroll Taxes For Your Small Business

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Federal Income Tax

How To Calculate Payroll Taxes For Your Small Business